reverse sales tax calculator california

The statewide California sales tax rate is 725. Reverse Sales Tax Calculator Software Cleantouch General Production System v10 Accounting Inventory Formula Based Production Sales Tax System After keeping study of various.

California Proposes 16 8 Tax Rate Wealth Tax Again Time To Move

This rate is made up of 600.

. List price is 90 and tax percentage is 65. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Home Top Free Apps.

This Sales Tax Calculator And De-Calculator will calculate sales tax from an amount and tax or reverse calculate with the tax paid. How do you calculate tax. California has a 6 statewide sales tax rate but also has 469 local tax jurisdictions including cities towns counties and special districts that.

For a list of your current and historical rates go to the California City. California sales tax calculator is as per the California sales tax percentage rate effective 1st January 2020. Your employer withholds a 62 Social Security tax and a.

Sales Tax total value of sale x Sales Tax rate. Your household income location filing status and number of personal. Here is how the total is calculated before sales tax.

Usually the vendor collects the sales tax from the consumer as the consumer makes a. Amount without sales tax GST. Before tax price in case of Reverse.

If you want to know how much an item costs without the Sales Tax you might want to. California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. The price of the coffee maker is 70 and your state sales tax is 65. Multiply price by decimal.

Divide tax percentage by 100. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Additional sales tax is then added on depending on location by local government. Amount with sales tax 1 GST and QST. Putting everything together the average.

The Sales Tax Calculator over here finds out the Tax imposed on various goods and services easily and makes your calculations quick and simple. 65 100 0065. The base level state sales tax rate in the state of California is 6.

Here is the Sales Tax amount calculation formula. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate.

For example if the.

New Jersey 2022 Sales Tax Calculator Rate Lookup Tool Avalara

How To Calculate Sales Tax Backwards From Total

2021 Estate Income Tax Calculator Rates

Tax Rates Stripe Documentation

Understanding California S Sales Tax

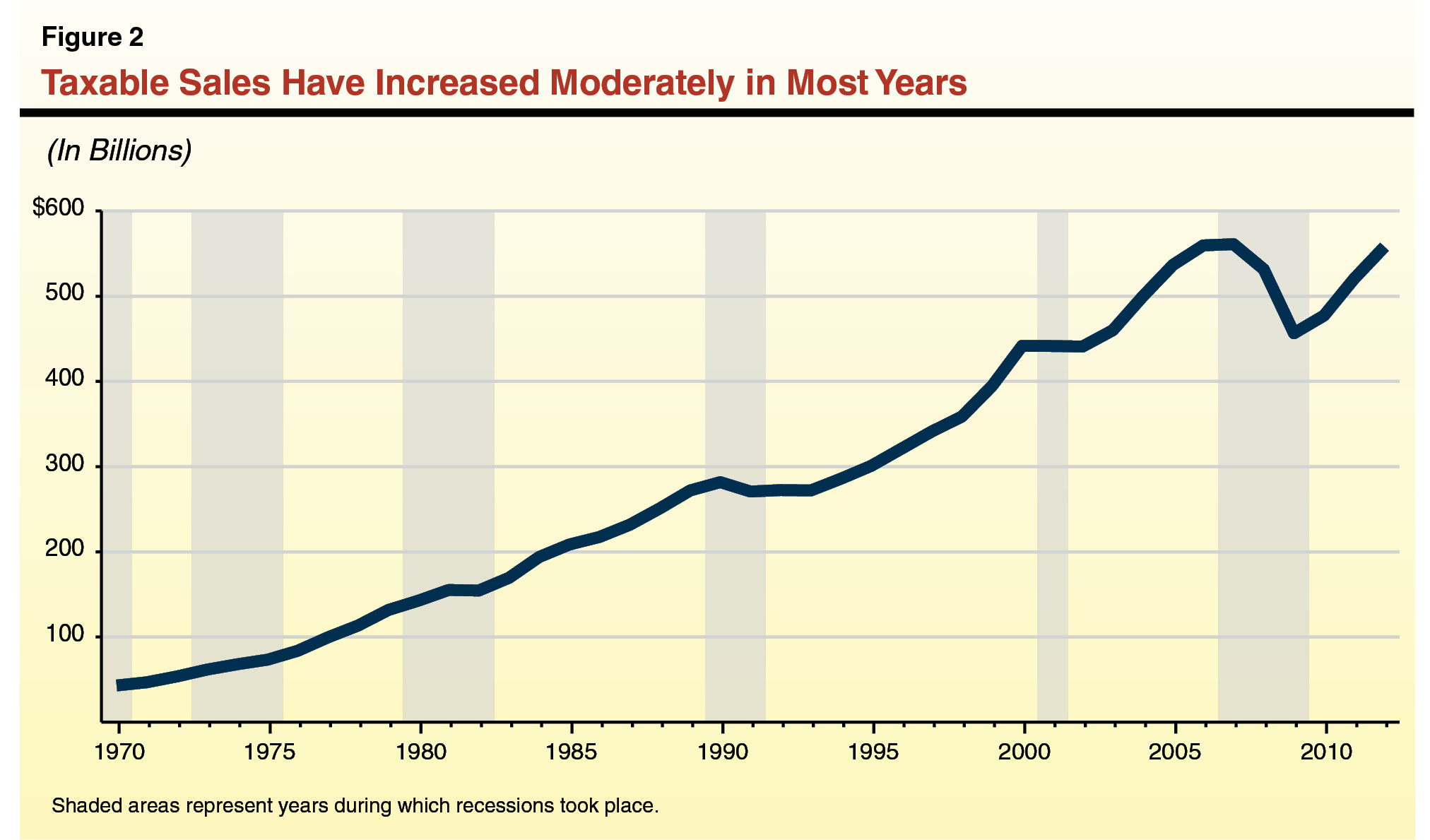

Why Have Sales Taxes Grown Slower Than The Economy

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Cannabis Taxes At Your Dispensary

Los Angeles Sales Tax Rate And Calculator 2021 Wise

How To Calculate Sales Tax Backwards From Total

Sales Tax Calculator Reverse Sales Tax Calculator

How To Easily Calculate Sales Tax Gst In Google Sheets Yagisanatode

Social Security Benefits Tax Calculator

1 125 Sales Tax Calculator Template

California Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com